Budget with a 30k salary

Congrats! You bring home 30k net per year (or $2,500 per month). Let’s take a look at what you can afford with this salary.

At this bracket of net revenue, you’ll probably feel a bit more free and less restrained by your finances. You don’t? Well, don’t forget to have

good financial habits in the first place!

Based on a

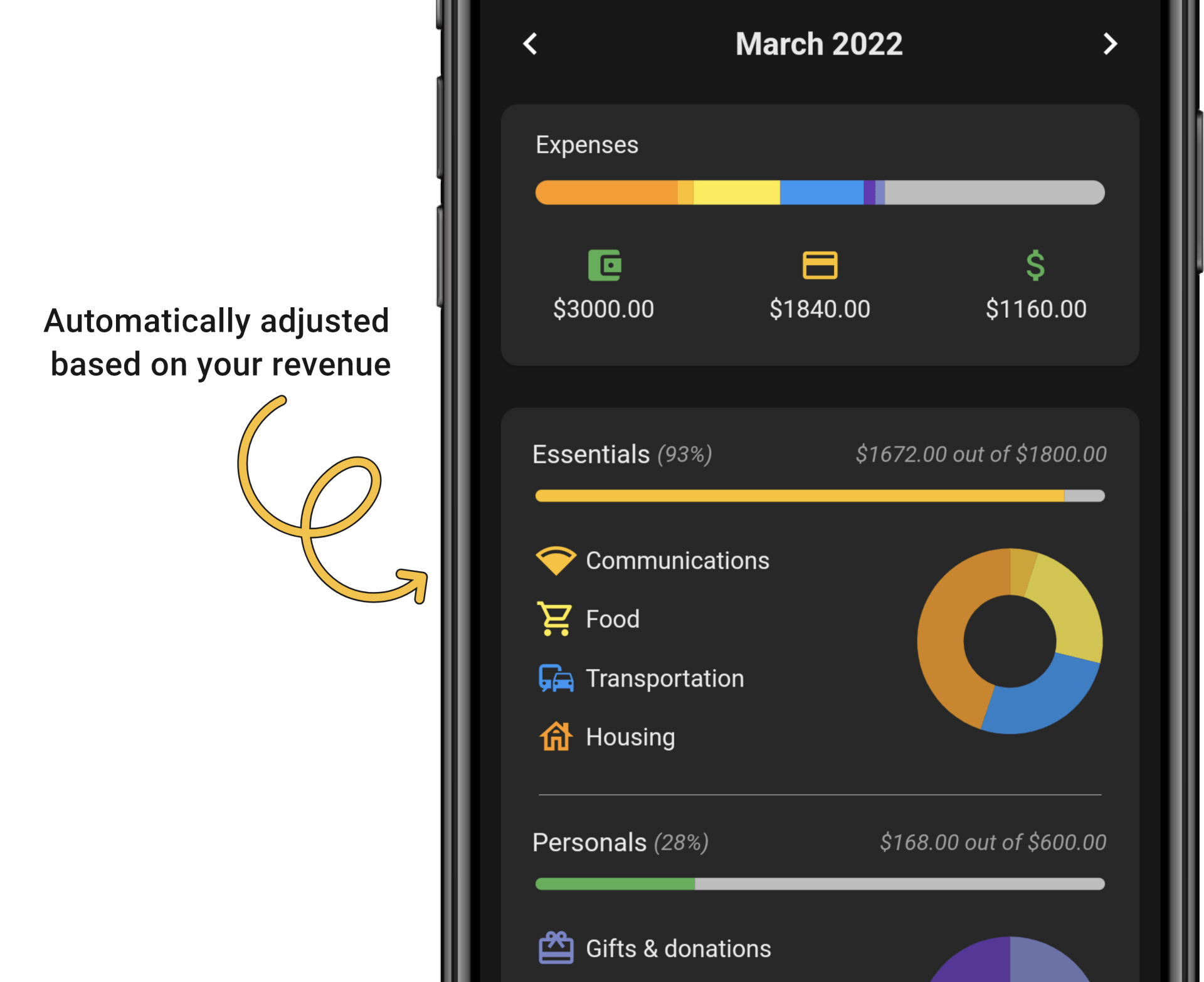

balanced budget split, you would get something like this:

- Essential expenses - $18,000 per year (or $1,500 per month)

- Housing: You can afford a small place for yourself or live better with roommates (depending on the locations). Anything below 750$ all included will allow you to handle your finances.

- Transport: You can comfortably afford public transportation, or a small car loan up to 250-300$ per month, and without too much gas consumption. If you don’t need to travel, you can take this amount and invest it in another category. For example, you can spend it in a more expensive apartment.

- Food - Groceries: You won’t need to run for coupons and deals, but keeping your grocery’s budget under $400 is still strongly recommended.

- Communications: Don’t overdo it for this type of expense yet, and keep it at $50-$60 per month.

- Personal expenses - $6,000 per year (or $500 per month)

With $500 per month for leisure, you’ll get plenty of nights out and can still enjoy some entertainment and fitness subscriptions.

- Savings - $6,000 per year ($500 per month)

At that amount saved per year, you can start to properly save for retirement and other projects. A monthly and minimal cash flow of $500 allows you to prevent unexpected expenses too.

Your monthly cash flow should be at least $500 to prevent a financial crisis.

Now that you have reached a better lifestyle, you can now play around different

budget splitting rules like

60/20/20,

50/30/20, and

70/15/15. Don’t forget that if you live downtown, the cost of living is always higher and should only be considered if you have reached a certain level in your career.

Disclaimer: This article’s goal is purely to give you inspiration and some advice on how to manage your finances. Most expenses are different between countries and it’s actually hard to represent it across the globe. Also, the salary is based on the net revenue—not the gross revenue. That way, it rules out taxation amounts, which differ by region, country etc.