Budget with a 20k salary

Alright! So you bring home 20k net per year (or $1,666 per month). Let’s take a look at what you can afford with this salary.

Of course, considering that this level of revenue is quite the entry-level, you need to stay very tight with your expenses and accept that for now, you won’t live the best life.

Based on a

balanced budget split, you would get something like this:

- Essential Expenses - $12,000 per year (or $1,000 per month)

- Housing: Live at your parents’ house or with roommates. Also, keep rent expenses below $400 or $500 with electricity/heating included (for yourself only, not the whole place). For example, if you are three people renting an apartment at $1,500 all included, that means $500 of rent per person. So that’s good!

- Transport: At this salary, do not afford yourself with a car loan. Don’t even think of having a brand new car. Keep it as cheap as possible. If possible, live on a BMW pass (Bus, Metro and Walk, heh)

- Food - Groceries: Deals will tell you what you eat every week. Become the master of coupons and save as much as you can so that your expenses remain below $300 a month.

- Communications: Androids are good phones (I’m using one myself!). Forget about expensive phones and mobile plans and keep it at a minimum. Same thing applies to the Internet plan.

- Personal Expenses - $4,000 per year (or $333 per month)

This is where you decide what to do with your money. At that salary, you can have a few night outs, a cheap gympass and some entertainment subscriptions.

It should also cover clothing from time to time.

And don’t forget to cut down on restaurants as much as you can! When it comes to food, rely more on your groceries, and spend on restaurant food sparingly.

- Savings - $4,000 per year ($333 per month)

Savings at this revenue level is not necessarily meant for retirement savings. Its main use is mostly as a secure placement for unforeseen situations.

Your monthly budget for savings should be at least $333 to prevent a financial crisis.

At this level, the best investment is to invest in yourself. This situation should be temporary while you get more professional experiences and certifications. It is definitely the hardest lifestyle but the most satisfying to jump out from. Keep it up :)

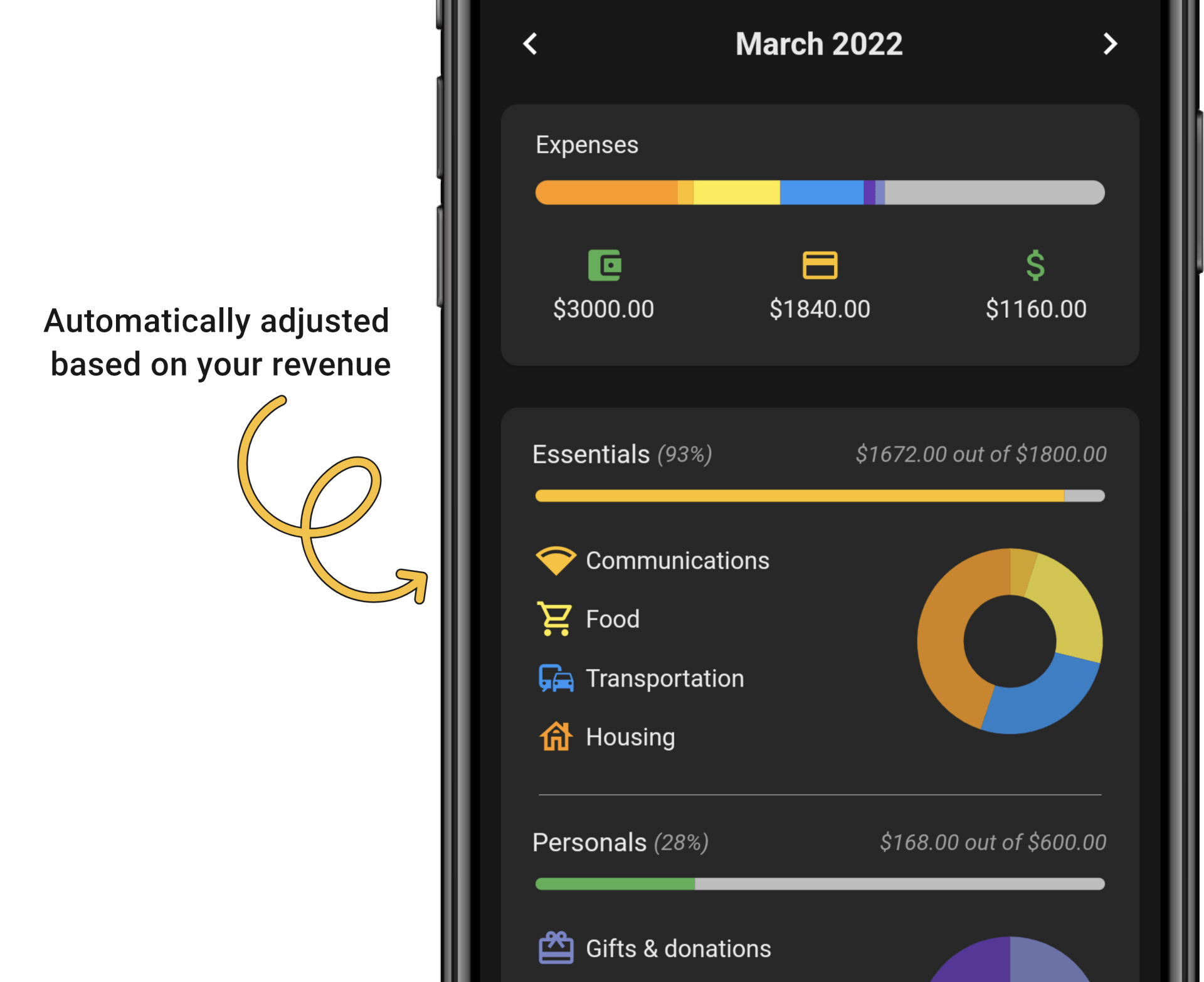

An app like Miza can help you tracking your expenses across all different categories. What more, using a

budget split method allows it to be automated.

Disclaimer: This article’s goal is purely to give you inspiration and some advice on how to manage your finances. Most expenses are different between countries and it’s actually hard to represent it across the globe. Also, the salary is based on the net revenue—not the gross revenue. That way, it rules out taxation amounts, which differ by region, country etc.