Budget Splitting Strategy

Ha! The famous budget splitting strategy. If you stumble here, it’s because you heard or read about one or more of these budget splitting rules called 60/20/20, 50/30/20, 70/15/15 or X/Y/Z.

Which one of these is the best? Well, based on your perspective, it's either none or all of them.

Here are the fundamental points to know about the budget splitting strategy and its budget splitting rules:

- The budget can be calculated monthly and yearly.

- The budget is split between three main categories: Essentials, Personal, and Savings.

- The three numbers in each rule represent the percentage portions of your monthly (or yearly) revenue to be allocated to these three categories. The percentage numbers add up to 100%.

- These three main categories are the same across all budget splitting rules.

Now, let’s dive in these categories and these different budget splitting rules.

The budget categories

Essentials

Most of the budget goes to the Essentials category (a.k.a. the Needs or “How am I supposed to live without that?” category). This is where you determine the things that are necessary for you to move forward in your life. For example, it’s in this category that you will allocate your housing, grocery (no restaurants though!), and transportation expenses.

Personal

You only live one life, so of course the second biggest category is the Personal category (a.k.a. the Want or “It’s party time and I want to spoil myself” category). That’s the amount you’ll be budgeting for your personal purchases. Some examples are restaurants, clothing, activities, traveling and so on.

Savings

We still want to be in good financial health throughout our life and reach personal goals. So, having said that, this budgeting strategy also takes into account a Savings category in which we allocate part of our income to either bigger purchases and/or retirement. This is as easy as just letting the monthly leftovers stack up or using saving accounts to better manage these savings.

The monthly/yearly revenue’s percentage portion that you associate with each category depends mostly on your life situation or lifestyle. For example, a student living at their parents’ house will have a different split than, ahem, their own parents!

To find out how much you should allocate to each category, let’s look into these budget splitting rules.

The budget splitting rules

Here, we briefly describe the different budget splitting rules to give you an idea of what each rule focuses on. That way, it will help you determine which kind of split fits best with you.

You can always find more detail on each rule in their own page.

The 60/20/20 budget rule

The 60/20/20 rule is one of the oldest out there. It used to represent a balanced allocation of your income between Essentials, Personals and Savings.

It has enough room to settle for a nice lifestyle depending on your family situation.

The 50/30/20 budget rule

The 50/30/20 rule has become very popular over the last few years, mostly because active and young people want to have a budget that fits their lifestyle.

By following this rule, you’d be cutting down a bit on the Essentials - by living in a smaller place and/or probably not having a loan/lease on a car - and allocate more expenses in the Personal category. This gives a lot more room for activities, traveling, having pets, etc.

Of course, adopting this rule with a full-blown family can be tricky, unless you have covered most of your housing and car expenses to a point where these expenses become very low.

The 70/15/15 budget rule

The 70/15/15 rule is helpful for any type of family. Family of 4? Single-parent of one or many children? This type of budget splitting will definitely help you better manage your finances and overcome all types of financial situations you’ll be facing.

This rule’s main focus is about the essentials that are required to run your family and giving you great flexibility to make sure everyone is happy.

The X/Y/Z budget rule

This budget splitting rule is customizable; you can decide yourself on the percentage you want to allocate for each category. You can also adjust this rule depending on where you’re at in life and what your priorities are. For example, if you don’t feel like saving at all, go for it and opt for something like a 80/20/0 rule. Or, maybe you’d want to prioritize saving a lot of money and so you could try something like a 20/20/60 rule.

The idea is to simply track 100% of your expenses based on the actual cash flow and make decisions accordingly.

Now that you’ve decided…

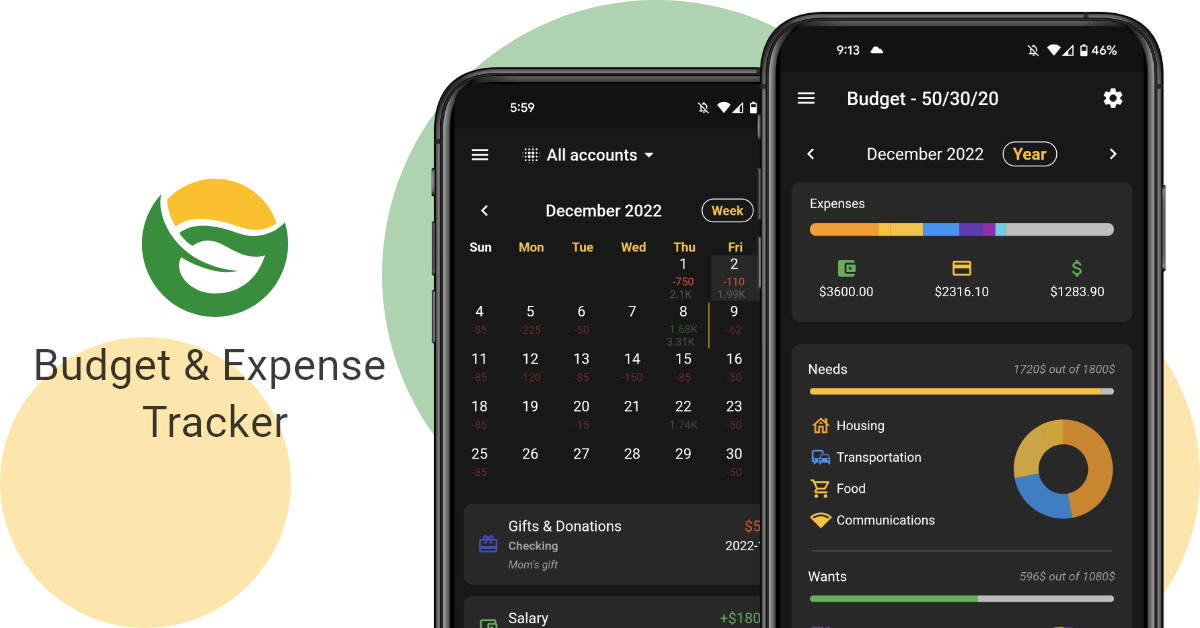

Would you like to apply these strategies easily? Our app Miza offers the three main views that are automatically adjusted as you keep track of your transactions. Try it now and let us know what you think :)