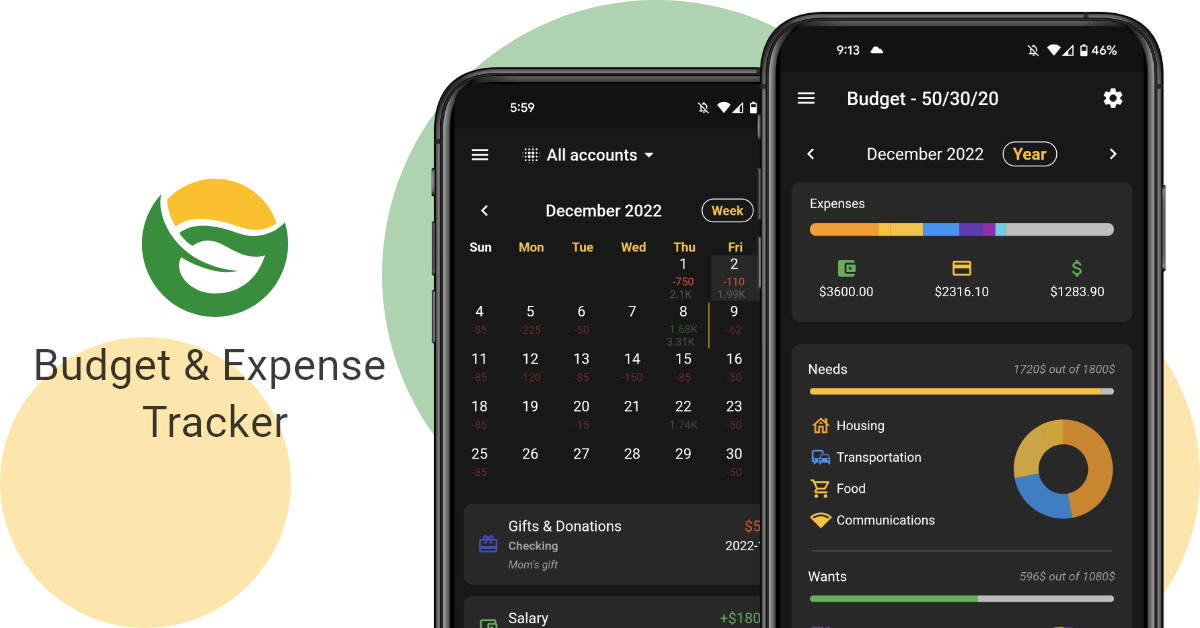

50/30/20 Budget Rule

Do you often wonder what amounts you should allocate to your expense categories? The budget splitting strategy and its splitting rules are effective tools to use when asking this question. Miza actually calculates each category’s budget based on these different rules, which are simple and effective techniques to properly determine your personal finances.

One of them is called the 50/30/20 rule, which is the very topic of this page!

Where does this rule come from?

The 50/30/20 rule was first disclosed in

Elizabeth Warren's book "All Your Worth" written with her daughter Amelia Tyagi. Elizabeth is a former Massachusetts State Senator and has spent most of her career in personal finance management.

What does this budget rule say?

This rule suggests breaking down your net revenue in a structure that

focuses more on personal purchases:

- 50% of your income is on basic needs. These needs include rent and related items, transportation, communications, and food (grocery only, no restaurants!).

- 30% of your income is on your personal expenses. This includes the famous restaurant outings, your various monthly subscriptions, the purchase of clothing and everything related to care services.

- 20% of income is set aside for savings. Whether it is for a project, a down payment, a financial cushion, keeping a 20% aside is a first step for financial balance.

Considering that the ratios of basic needs and personal expenses are rather close, this rule focuses more on an active lifestyle. If you have a house or prefer to put more budget on your home, I strongly recommend the

60/20/20 rule or the

70/15/15 rule.

An example please

Let’s say someone earns $3,000 net per month, then this income’s breakdown could be something like this for every month:

- $1,500 for basic needs. This amount’s breakdown could look like this:

- $700 on rent (or a rent of 1,400 divided by two)

- $400 on groceries

- $60 on electricity

- $240 on car-related expenses (car lease and insurance)

- $100 on gas

These are just examples, because if you live in the city, you don't pay necessarily for a car or gas, but rather have a public transport pass. Also, at this salary, before even jumping on car payments, I strongly suggest starting with a paid car and building a solid financial cushion. Above all, ask yourself “how much should I save?”

- $900 for personal expenses. There’s plenty of room for several restaurant outings, several subscriptions and enough to cover a few hobbies, while remaining modest. This also includes visits to the hairdresser or any other similar services.

- $600 set aside per month. That's $7,200 per year; enough to have a solid financial padding and enough money to spare for several trips.

Conclusion

We understand very well that this rather severe strategy in terms of essential needs is not ideal for everyone, which is why our

Miza application offers the three segmentation rules in order to dynamically divide your budget according to your lifestyle!