60/20/20 Budget Rule

Do you often wonder what amounts you should allocate to your expense categories? The budget splitting strategy and its splitting rules are effective tools to use when asking this question. Miza actually calculates each category’s budget based on these different rules, which are simple and effective techniques to properly determine your personal finances.

One of them is called the 60/20/20 rule, which is the very topic of this page!

Where does this rule come from?

The 60/20/20 rule was first mentioned in

Scott Pape's book

The Barefoot Investor: The Only Money Guide You'll Ever Need. Scott devoted his career from an early age to personal finance. The first version of his book was released in 2004 and it has been revised many times over the years. The official version released in 2016 is one of the best-selling books in Australia.

What does this budget rule say?

This rule suggests breaking down your net revenue in a

balanced structure between essential and personal expenses:

- 60% of your income is on basic needs. These needs include rent and related items, transportation, communications, and food (grocery only, no restaurants!).

- 20% of your income is on your personal expenses. This includes the famous restaurant outings, your various monthly subscriptions, the purchase of clothing and everything related to care services.

- 20% of income is set aside for savings. Whether it's for a trip, a down payment, a financial cushion, keeping 20% of your income aside is a first step for financial balance.

Being pretty well balanced, I'd say this rule is probably the one that would work for most people. With a

balanced lifestyle between essential and personal expenses, you will be able to save money and enjoy life.

If you're more of the active type and would like to focus more on activities, the

50/30/20 rule would suit you better. If you'd rather spend your income on essential expenses because your family is growing, a rule like the

70/15/15 rule would be more suitable.

An example please

Let’s say someone earns $3,000 net per month, then this income’s breakdown could be something like this for every month:

- $1800 on basic needs. This amount’s breakdown could look like this:

- $800 on rent (or a rent of 1,600 divided by two)

- $400 on groceries

- $60 on electricity

- $440 on car-related expenses (car lease and insurance)

- $100 on gas

Remember that these are just examples, because if you live in the city, you don't necessarily pay for a car or gas, but rather have a public transport pass. Also, at this salary, before even embarking on car payments, I strongly suggest starting with a paid car and building a solid financial cushion. Above all, ask yourself “how much should I save?”

- $600 on personal expenses. Just enough for a visit to the hairdresser, a few dining outs and a few subscriptions from which you should choose your favorites.

- $600 set aside. That's $7,200 per year; enough to have a solid financial padding and enough money to spare for several trips.

Conclusion

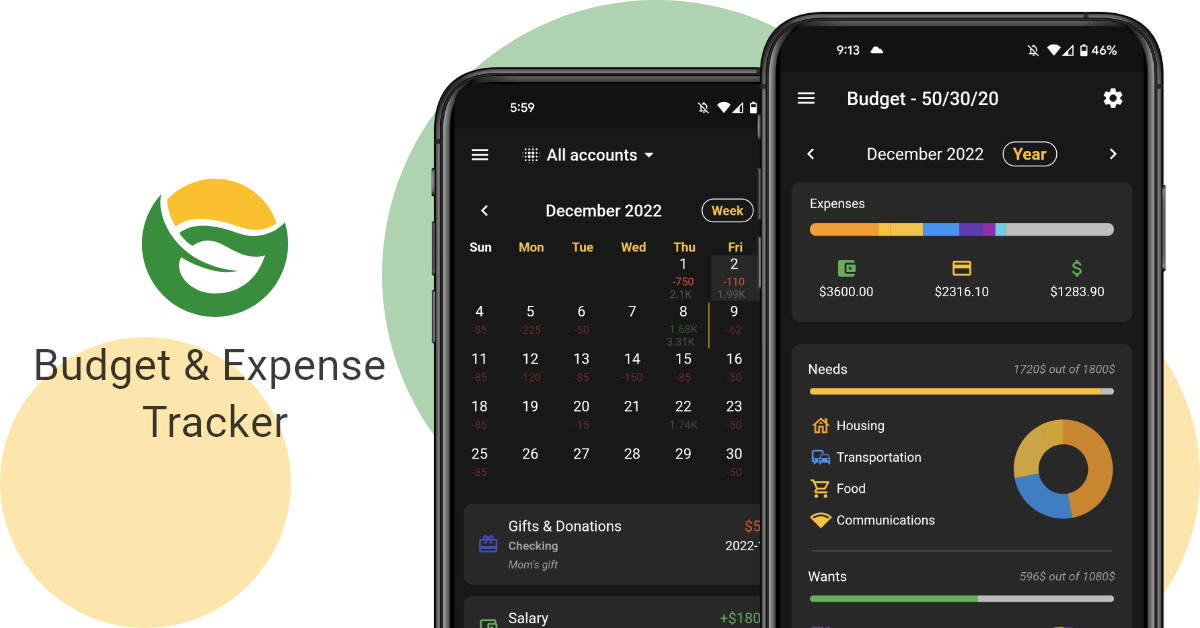

With the 60/20/20 rule, it's pretty easy to balance your expenses. This is also our default option in our

Miza budget app. You will also find the other segmentation rules that dynamically adjust your budget according to your transactions!